Tobacco Giant Altria Acquires Green Smoke E-cigarettes for $110 Million

Altria Group Inc., one of the Big Three tobacco companies in the United States, and owner of the popular Marlboro cigarette brand, has announced an agreement to acquire Green Smoke Electronic Cigarettes for $110 million.

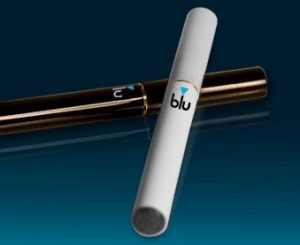

Not too long ago, tobacco companies were going out of their way trying to get electronic cigarettes banned, but they seem to have realized that simply taking over this booming industry is far easier and even more profitable. In 2012, Lorillard took the plunge first, by acquiring Blu electronic cigarettes, for $135 million. According to recently released data, the e-cigarette division now makes up for 4% of the companies total revenue and is the leading US e-cigarette brand. That figure may not seem very impressive, but it’s growing at a very rapid pace, thanks to Lorrilard’s well-established chains of distribution and aggressive marketing campaigns. Shortly after the acquisition, the other tobacco giants announced their own intentions to enter this highly lucrative market, either by making acquisitions of their own or developing their own products.

Not too long ago, tobacco companies were going out of their way trying to get electronic cigarettes banned, but they seem to have realized that simply taking over this booming industry is far easier and even more profitable. In 2012, Lorillard took the plunge first, by acquiring Blu electronic cigarettes, for $135 million. According to recently released data, the e-cigarette division now makes up for 4% of the companies total revenue and is the leading US e-cigarette brand. That figure may not seem very impressive, but it’s growing at a very rapid pace, thanks to Lorrilard’s well-established chains of distribution and aggressive marketing campaigns. Shortly after the acquisition, the other tobacco giants announced their own intentions to enter this highly lucrative market, either by making acquisitions of their own or developing their own products.

R.J. Reynolds launched its VUSE e-cigarette last year in a small test market, and the results exceeded even the most optimistic expectations. In a matter of months, VUSE established a market share of 55.6% in Colorado, leaving Blu with 25.6% and NJOY with just 7.3%. The company announced it would push its brand of electronic cigarettes nationwide in the first half of 2014. The Altria Group also launched its own brand of e-cigs, NuMark, in Indiana, with impressive results, but the maker of Marlboro apparently decided another big move was necessary if it was going to catch up to its two aforementioned rivals, so it recently acquired one of the world’s most popular e-cigarette brands, Green Smoke. The agreement is set to go through for $110 million, subject to closing adjustments, plus

“Nu Mark’s entry into the e-vapor category with its MarkTen product was an important development in Altria’s innovation strategy. Adding Green Smoke’s significant e-vapor expertise and experience, along with its supply chain, product lines and customer service, will complement Nu Mark’s capabilities and enhance its competitive position,” said Marty Barrington, Altria’s chairman and CEO. “Further, Green Smoke’s culture of innovation and history of producing high-quality products are consistent with Altria’s culture.”

The agreement is set to go through for $110 million, subject to closing adjustments, plus up to $20 million in incentive payments. It also contains provisions to keep key management infrastructure and talent. “We are very pleased to be joining the Altria family of companies,” Robert Levitz, Green Smoke’s CEO said. “We are dedicated to innovation and believe joining Nu Mark will help us deepen that expertise and create new opportunities for our customers, our employees and our products.”

Green Smoke E-Cigarettes has generated $40 million in revenue last year, mostly by selling rechargeable and disposable electronic cigarettes online. The popular brand also has a small presence in convenience stores, but that is expected to change drastically as it can now benefit from Altria’s superior distribution chains.

Last year, Wells Fargo analyst, Bonnie Herzog, predicted the Big Three tobacco companies would ultimately dominate the US e-cigarette market, and it appears she was right. With Blu, VUSE and Green Smoke in Big Tobacco hands, they now control over half the e-cigarette sector. And they’re not stopping here. A few months back, Lorillard announced the acquisition of SKYCIG, one of the best-selling e-cig brands in the UK, thus establishing a foothold in the British market.

via CS News